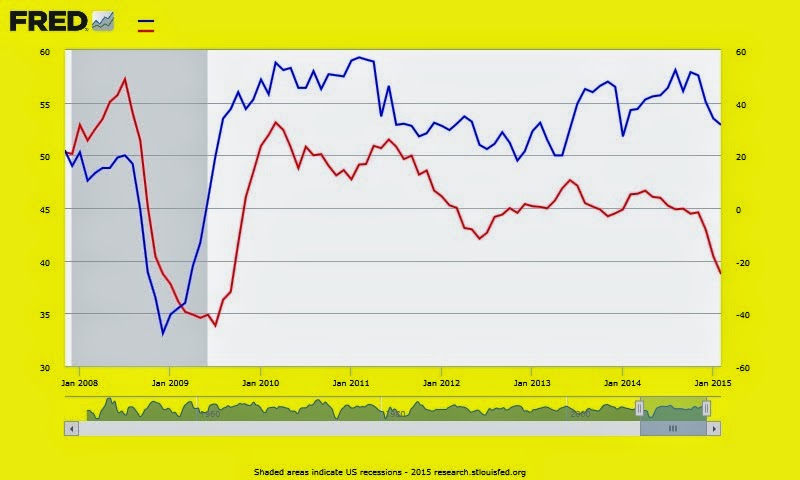

The above chart shows the ISM index for manufacturing (blue line) and the change of the PPI for crude goods (red line).

Commodities (using the above PPI as a proxy for commodities) rise following strength in manufacturing (ISM rises). Commodity weaken when manufacturing is slowing down.

Right now manufacturing is slowing down and commodities are weakening. In other words, a weaker economy forces prices to grow slower.

The important point I want to make is that these ups and downs do not happen by chance My work shows that when the Fed eases, economy and prices rise. When the Fed is following a tightening policy the economy slows down and commodities decline.

The recent weakness in the economy (see previous posts) is not happening by chance or because of the weather. The fundamental reason is the Fed (willingly or unwillingly) has been tightening since early 2014.

the bottom line is this. If I am correct the economy is likely to weaken even further and commodities will keep heading lower.

These trends will have a major and defining effect on the stock market and bond yields.

Of course, if I am correct. Time will tell.

More details in The Peter Dag Portfolio on www.peterdag.com

George Dagnino, PhD

Editor

The Peter Dag Portfolio

Since 1977

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility. The Peter Dag Portfolio

Since 1977

STRATEGIC INVESTING FOR UNCERTAIN TIMES.

Learn how to manage your portfolio risk and sleep comfortably. Improve the certainty of returns by taking advantage of business cycle trends. Learn to use simple hedging strategies to minimize the volatility of your portfolio and protect it from downside losses.

You will receive your user id to access 2 FREE issues – and all the previous ones - of The Peter Dag Portfolio. Email your request to info@peterdag.com. New subscribers, please.

FOLLOW ME ALSO ON TWITTER @GEORGEDAGNINO FOR MY LATEST VIEWS

No comments:

Post a Comment