The main function of the Federal Reserve is to control the growth of money and credit. Monetary policy is the set of actions that lead to the expansion of money and credit in such a way as to produce a stable growing economy at reasonable stable prices.

What this means is that the objective of the Fed is to achieve growth in the money supply to create an environment characterized by low inflation, usually expected to be below 2% with as little volatility as possible in the business cycle. Historical evidence suggests that inflation below 2% is close to price stability and is usually accompanied by stable economic growth not showing, for instance, the type of instability and volatility of the 1970s. The risk of following a low inflation policy is that it may lead to deflation under some conditions. Since deflation is the outright decline in consumer prices, it would create economic conditions that would not be beneficial for the country. Establishing an inflation target of 2%, therefore, creates a safety cushion in case of unexpected events.

The issue from the Federal Reserve standpoint is to determine the information needed to guide monetary policy to meet its ultimate objective. There has been a continuing debate about this for a number of years both inside and outside the Federal Reserve. Some have advocated that interest rates are the principal guide for monetary policy, in the belief that an interest rates guidelines can be related more dependably to current and prospective expenditures by key sectors of the economy and therefore to the ultimate economic objectives of full employment, reasonable price stability and international competitiveness.

However, others have advocated that growth in one or more measures of the money supply should be the main focus of the Federal Reserve. Since they believe that the control of the money stock will more surely and predictably lead to the overall economic effects that are desired, the focus of the Fed should be the money supply. Still others have taken an eclectic position. They believe that no one financial variable can or should be taken as a unique guide for monetary policy in view of the complexity of the economy, the wide variety of financial influences on spending, and the changing attitudes of businessmen, investors, and consumers toward spending and liquidity.

Clearly the issues are serious, broad, and very difficult to tackle. It is important to recognize what the issues of concern are for the Federal Reserve system and what their response to these issues is. We will then see how investors will assess the action of the Fed, assess their own issues and concerns and then derive a proper investment strategy.

Another important issue the Fed has to consider is the monetary problems that develop around the world, and their impact on the U.S. economy. Judgments have to be made continuously on what should be done and what kind of monetary policy should be followed. Whatever processes the FOMC goes through to reach a consensus and the resulting action taken by the FOMC, there are two main results of monetary policy. One is the growth in the money supply and the second is the trend and level of real short-term interest rates.

Let's talk about the money supply and how it is defined. There are several measures of money supply. It is important to recognize the difference between them. From an investor's viewpoint, they provide the same information. But sometimes some measures are better than others, so it is always important to understand these definitions. There are times when because of technological innovation or changes in the structure of the banking system, some measures of money supply become distorted. For this reason, it is always appropriate to follow many measures and recognize that some may be distorted because of temporary factors. Money supply data are available from the Fed every week through the Internet and also the historical data are also available on the websites of the Fed or the Federal Reserve Bank of St. Louis.

There are three measures of money supply. The first one is called M1 and consists of currency, travelers' checks of non-bank issuers, and demand deposits at all commercial banks. The second measure of money supply (M2) is M1 plus savings deposits including money market savings accounts, small denomination time deposits and balances in retail money market funds. The third measure of money supply is M3, which consists of M2 plus large denomination time deposits in the amount of $100,000 or more, balances in institutional money funds, and Eurodollars held by U.S. residents in foreign banks.

Money supply is a measure of how much money is in the economy - M1 is a narrow definition of the money supply, M2 is a broader definition of the money supply, and M3 is an even broader definition of the money supply. There is a fourth definition, which is called MZM - that is, money with zero maturity (Fig. 6-2).

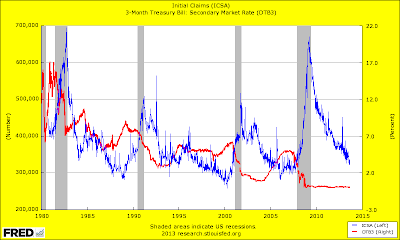

An increase in the growth of the MZM is followed by a stronger economy, which is followed by rising short-term interest rates. The rise in short-term interest rates reduces the demand for money (negative feedback), inducing a decline in the growth of the MZM, of the economy and eventually causing short-term interest rates to decline. Lower short-term interest rates cause an increase (positive feedback) in the demand for money and rising growth in the money supply MZM.

It is defined as M2 plus institutional money funds, minus total small denomination time deposits. This measure of money supply is available from the web site of the Federal Reserve Bank of St. Louis, which computes it every week.

There are many assets closely related to cash and the public can readily switch between cash and these other liquid assets. Much of the time, switches are in response to changing interest rate differentials between these assets. At other times though, the switches may reflect a growing awareness of a way to increase income or they may simply reflect shifting attitudes of the public.

All these factors impact in different ways the various measures of money supply.

From an investor viewpoint, following the money supply is crucial because the growth of the money supply is a very important leading indicator of the economy. For instance, the growth of the money supply bottomed in 1984 and increased sharply in 1985 and 1986. The bottom in the growth of the money supply was followed in 1986 by a strong pick-up in the growth of industrial production. In 1992 the growth of the money supply peaked and declined sharply until 1995. The growth in industrial production peaked two years afterwards in late 1994 and early 1995 and declined for a year. The growth in the money supply is a very important leading indicator of the economy and predicts turning points in the economy both at troughs and at peaks with a lead of more than one year. The typical measure that is used is the rate of change in the money supply over twelve months.

Strong growth in the money supply suggests there is a lot of liquidity being injected into the economy and there is a lot of credit available to business, investors and consumers. As this liquidity moves through the economy, more and more people take advantage of this liquidity. Eventually they will spend it, the economy strengthens and economic growth increases. However, when the money supply starts to slow down, credit is made available at a lesser pace to business investors and consumers. Therefore, the economy gradually slows down as less money is available and less money is spent. Historical data show that financial cycles, defined as the fluctuation in the growth of the money supply, have a length of approximately five years from trough to trough.

Of course, one should expect that as liquidity increases the stock market performs well and as liquidity decreases, that is the rate of growth of the money supply declines, there is less reason for stock prices to rise.

(From Chapter 6 of my book Profiting in Bull or Bear Markets. Published also in Mandarin and on sale in China. The book is available at Amazon.com).

George Dagnino, PhD Editor,

The Peter Dag Portfolio.

Since 1977

2009 Market Timer of the Year by Timer Digest

Portfolio manager

Disclaimer.The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

STRATEGIC INVESTING FOR UNCERTAIN TIMES.

Learn how to manage your portfolio risk and sleep comfortably. Improve the certainty of returns by taking advantage of business cycle trends. Learn to use simple hedging strategies to minimize the volatility of your portfolio and protect it from downside losses.

Receive your user id to access 4 FREE issues – and all the previous ones - of The Peter Dag Portfolio. Email your request to info@peterdag.com. New subscribers, please.

FOLLOW ME ON TWITTER @GEORGEDAGNINO FOR MY LATEST VIEWS.

.jpg)

.png)