The auto and housing sectors are two major parts of the US economy. They rose rapidly since the end of the Great Recession in 2009. Unfortunately now they seem to have stalled.

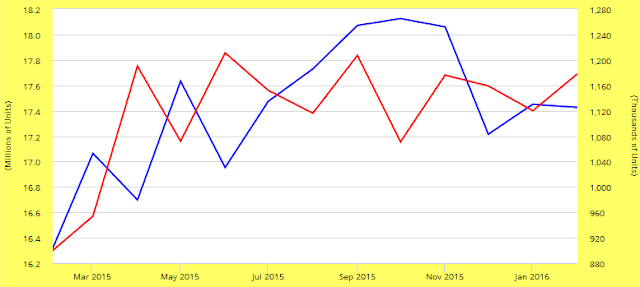

The above chart shows auto sales (blue line, left scale) and housing starts (red line, right scale).

The above graphs show auto sales are lower than the levels reached in May 2015. almost a year ago, while housing starts peaked in April 2015.

The bottom line is this evidence confirms the US economy is growing at a pace very close to zero percent. It may very well be the reason the Fed did not force interest rates higher at the latest FOMC meeting.

As we have maintained for a long time (see previous posts), a slow growing economy places downward pressure on commodities, yields, and earnings.

The business cycle is alive and well.

You will encourage my timely update of this blog on the economy and financial markets by entering a subscription to The Peter Dag Portfolio.

Thank you for visiting this site.

George Dagnino, PhD

Editor, The Peter Dag Portfolio

Since 1977

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

Subscribe now and learn "EASY WAYS TO BEAT THE MARKET WITH ETFs". Several portfolios back-tested from 2000 are shown in the subscribers' area on our website (www.peterdag.com) when you subscribe. Total returns, annualized returns, maximum losses during the period, and number of transactions are shown for each portfolio. The rules are easy to follow and you will find them in the appendix of each issue of The Peter Dag Portfolio. These portfolios are provided as a service to our subscribers.

Thank you for visiting this site.

George Dagnino, PhD

Editor, The Peter Dag Portfolio

Since 1977

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

Subscribe now and learn "EASY WAYS TO BEAT THE MARKET WITH ETFs". Several portfolios back-tested from 2000 are shown in the subscribers' area on our website (www.peterdag.com) when you subscribe. Total returns, annualized returns, maximum losses during the period, and number of transactions are shown for each portfolio. The rules are easy to follow and you will find them in the appendix of each issue of The Peter Dag Portfolio. These portfolios are provided as a service to our subscribers.

No comments:

Post a Comment