This is a scary chart showing a scary indicator.

The reason it is scary is because this measure has an uncanny record of pointing to a recession since the 1940s (shaded areas indicate recessions).

Slow growth is - of course - bad news for commodities and profits. Bonds should benefit, however, in this environment.

Can the stock market ignore the message of this indicator and keep moving higher? How long can it ignore the economic reality as anticipated by the above gauge?

Details will be discussed in depth in the next issue of The Peter Dag Portfolio.

You will encourage my timely update of this blog on the economy and financial markets by entering a subscription to The Peter Dag Portfolio.

Thank you for visiting this site.

George Dagnino, PhD

Editor, The Peter Dag Portfolio

Since 1977

Author, Profiting in Bull and Bear Markets

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

Subscribe now and learn "EASY WAYS TO BEAT THE MARKET WITH ETFs". Several portfolios back-tested from 2000 are shown in the subscribers' area on our website (www.peterdag.com) when you subscribe. Total returns, annualized returns, maximum losses during the period, and number of transactions are shown for each portfolio. The rules are easy to follow and you will find them in the appendix of each issue of The Peter Dag Portfolio. These portfolios are provided as a service to our subscribers.

The market is facing unfavorable seasonality going into April-May-June.

Details will be discussed in depth in the next issue of The Peter Dag Portfolio.

You will encourage my timely update of this blog on the economy and financial markets by entering a subscription to The Peter Dag Portfolio.

Thank you for visiting this site.

George Dagnino, PhD

Editor, The Peter Dag Portfolio

Since 1977

Author, Profiting in Bull and Bear Markets

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

Subscribe now and learn "EASY WAYS TO BEAT THE MARKET WITH ETFs". Several portfolios back-tested from 2000 are shown in the subscribers' area on our website (www.peterdag.com) when you subscribe. Total returns, annualized returns, maximum losses during the period, and number of transactions are shown for each portfolio. The rules are easy to follow and you will find them in the appendix of each issue of The Peter Dag Portfolio. These portfolios are provided as a service to our subscribers.

Bad news. The indicator (red line) shown in the above chart leads the market by several quarters. Right not it is plunging.

Two developments are likely to happen according to this gauge (see above chart).

1. The economy is likely to slide into a recession.

2. The stock market (blue line, Wilshire index, left scale) will follow this gauge and decline further.

Details will be discussed in depth in the next issue of The Peter Dag Portfolio.

You will encourage my timely update of this blog on the economy and financial markets by entering a subscription to The Peter Dag Portfolio.

Thank you for visiting this site.

George Dagnino, PhD

Editor, The Peter Dag Portfolio

Since 1977

Author, Profiting in Bull and Bear Markets

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

Subscribe now and learn "EASY WAYS TO BEAT THE MARKET WITH ETFs". Several portfolios back-tested from 2000 are shown in the subscribers' area on our website (www.peterdag.com) when you subscribe. Total returns, annualized returns, maximum losses during the period, and number of transactions are shown for each portfolio. The rules are easy to follow and you will find them in the appendix of each issue of The Peter Dag Portfolio. These portfolios are provided as a service to our subscribers.

Orders for durable goods sank 2.8% in February. This is really bad news for the economy.

But what is even worse is orders for capital investments remain weak (see above chart).

You see these patterns during recessions. The economy cannot grow without strong investment in productive capacity. Productivity is hurting.

Our leaders should worry about these trends. They are a sign business is uneasy about the future.

Of course, a slow growing economy will depress prices of commodities, hurt profits, and keep yields from rising.

The business cycle is alive and well.

You will encourage my timely update of this blog on the economy and financial markets by entering a subscription to The Peter Dag Portfolio.

Thank you for visiting this site.

George Dagnino, PhD

Editor, The Peter Dag Portfolio

Since 1977

Author, Profiting in Bull and Bear Markets

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

Subscribe now and learn "EASY WAYS TO BEAT THE MARKET WITH ETFs". Several portfolios back-tested from 2000 are shown in the subscribers' area on our website (www.peterdag.com) when you subscribe. Total returns, annualized returns, maximum losses during the period, and number of transactions are shown for each portfolio. The rules are easy to follow and you will find them in the appendix of each issue of The Peter Dag Portfolio. These portfolios are provided as a service to our subscribers.

Business sales peaked in July 2014 (see above chart, shaded areas indicate recessions).

The decline in business sales is forcing manufacturers to cut production to keep inventories in line with declining sales. One of the main reasons for recessions to happen is the need of business to correct inventory imbalances.

The outcome is going to be weak commodities, stable or lower bond yields, and poor earning growth.

The business cycle is alive and well.

You will encourage my timely update of this blog on the economy and financial markets by entering a subscription to The Peter Dag Portfolio.

Thank you for visiting this site.

George Dagnino, PhD

Editor, The Peter Dag Portfolio

Since 1977

Author, Profiting in Bull and Bear Markets

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

Subscribe now and learn "EASY WAYS TO BEAT THE MARKET WITH ETFs". Several portfolios back-tested from 2000 are shown in the subscribers' area on our website (www.peterdag.com) when you subscribe. Total returns, annualized returns, maximum losses during the period, and number of transactions are shown for each portfolio. The rules are easy to follow and you will find them in the appendix of each issue of The Peter Dag Portfolio. These portfolios are provided as a service to our subscribers.

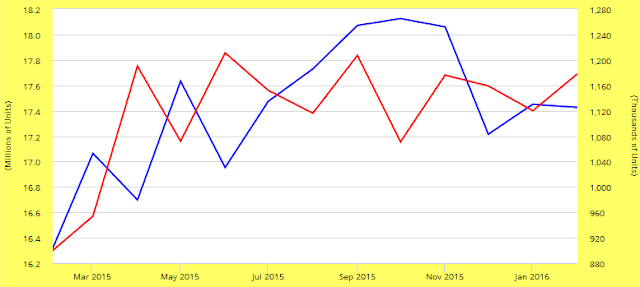

The auto and housing sectors are two major parts of the US economy. They rose rapidly since the end of the Great Recession in 2009. Unfortunately now they seem to have stalled.

The above chart shows auto sales (blue line, left scale) and housing starts (red line, right scale).

The above graphs show auto sales are lower than the levels reached in May 2015. almost a year ago, while housing starts peaked in April 2015.

The bottom line is this evidence confirms the US economy is growing at a pace very close to zero percent. It may very well be the reason the Fed did not force interest rates higher at the latest FOMC meeting.

As we have maintained for a long time (see previous posts), a slow growing economy places downward pressure on commodities, yields, and earnings.

The business cycle is alive and well.

You will encourage my timely update of this blog on the economy and financial markets by entering a subscription to The Peter Dag Portfolio.

Thank you for visiting this site.

George Dagnino, PhD

Editor, The Peter Dag Portfolio

Since 1977

Author, Profiting in Bull and Bear Markets

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

Subscribe now and learn "EASY WAYS TO BEAT THE MARKET WITH ETFs". Several portfolios back-tested from 2000 are shown in the subscribers' area on our website (www.peterdag.com) when you subscribe. Total returns, annualized returns, maximum losses during the period, and number of transactions are shown for each portfolio. The rules are easy to follow and you will find them in the appendix of each issue of The Peter Dag Portfolio. These portfolios are provided as a service to our subscribers.

Those of you who follow my blog know I pay close attention to the relationship between business sales and inventories (see previous posts).

When the inventories rise faster than sales there is only one option left for business - cut production in order to reduce costs.

The current imbalance between inventories and sales has been going on for months. It is no surprise therefore to see industrial production peaking in December 2014 and declining since then, as I anticipated ( see above chart, shaded areas indicate recessions).

The bottom line is the current imbalance between inventories and sales will cause industrial production to decline further. This trend is bad news for profits and commodities. Bond yields are likely to decline during the slower growth phase of the business cycle.

You will encourage my timely update of this blog on the economy and financial markets by entering a subscription to The Peter Dag Portfolio.

Thank you for visiting this site.

George Dagnino, PhD

Editor, The Peter Dag Portfolio

Since 1977

Author, Profiting in Bull and Bear Markets

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

Subscribe now and learn "EASY WAYS TO BEAT THE MARKET WITH ETFs". Several portfolios back-tested from 2000 are shown in the subscribers' area on our website (www.peterdag.com) when you subscribe. Total returns, annualized returns, maximum losses during the period, and number of transactions are shown for each portfolio. The rules are easy to follow and you will find them in the appendix of each issue of The Peter Dag Portfolio. These portfolios are provided as a service to our subscribers.

Just released. Business sales declined in January while inventories rose. The outcome is the inventory to sales ratio keeps rising (see above chart).

Business keeps adding to inventories in a dangerous way because rising inventory costs hinder profitability.

There is only one solution. Business needs to cut the growth of inventories and this can only be done by reducing production in an environment of weak sales.

This state of affairs is bad news for the economy and for profits. Commodities cannot rise in this environment.

The business cycle is alive and well in spite of the excessive interference of the Fed.

You will encourage my timely update of this blog on the economy and financial markets by entering a subscription to The Peter Dag Portfolio.

Thank you for visiting this site.

George Dagnino, PhD

Editor, The Peter Dag Portfolio

Since 1977

Author, Profiting in Bull and Bear Markets

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

Subscribe now and learn "EASY WAYS TO BEAT THE MARKET WITH ETFs". Several portfolios back-tested from 2000 are shown in the subscribers' area on our website (www.peterdag.com) when you subscribe. Total returns, annualized returns, maximum losses during the period, and number of transactions are shown for each portfolio. The rules are easy to follow and you will find them in the appendix of each issue of The Peter Dag Portfolio. These portfolios are provided as a service to our subscribers.

The blue line is the graph of the stock market. The red line is a proprietary financial risk indicator (FR). It is one of the several gauges we follow in The Peter Dag Portfolio to asses financial risk. Click on the chart to enlarge it.

FR was stable until the end of 2014 and the mode of the market was bullish.

FR started rising in 2015 and the market eventually crashed in August of that year.

FR stabilized and the equity market established a base and then rallied until November 2015.

FR resumed its rise toward the end of 2015 and stock crashed again in January 2016.

FR stabilized in mid January and the market soared again. It is still very strong thanks to the ECB aggressive easing.

The problem is FR has been rising since February 10. Will history repeat itself?

Stay updated with the next issues of The Peter Dag Portfolio.

You will encourage my timely update of this blog on the economy and financial markets by entering a subscription to The Peter Dag Portfolio.

Thank you for visiting this site.

George Dagnino, PhD

Editor, The Peter Dag Portfolio

Since 1977

Author, Profiting in Bull and Bear Markets

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

Subscribe now and learn "EASY WAYS TO BEAT THE MARKET WITH ETFs". Several portfolios back-tested from 2000 are shown in the subscribers' area on our website (www.peterdag.com) when you subscribe. Total returns, annualized returns, maximum losses during the period, and number of transactions are shown for each portfolio. The rules are easy to follow and you will find them in the appendix of each issue of The Peter Dag Portfolio. These portfolios are provided as a service to our subscribers.

I have been writing in The Peter Dag Portfolio for some time that the backbones of the economy were two major sectors: auto and housing.

I have also been saying the torrid pace of auto sales (more than 17 million units sold) represented a peak. The growth had to slow down because the number of units sold was close to a historical high.

A slowdown in the auto sector would represent another major headwind for the economy - besides concerning credit issues.

The above graph (via ZeroHedge) shows the inventory to sales ratio of the auto sector. Its upward trend and high level are saying inventories are rising faster than sales. Furthermore, the imbalance has reached pre-2008 levels.

Manufacturers need to reduce production in order to reduce auto inventories. The cut in production will further weaken the economy in a major way.

A weaker economy will have a negative impact on commodity prices, earnings, and equity prices. Bond prices, on the other hand, will be a beneficiary.

As you can see the business cycle is alive and well in spite of the misplaced generosity and goodwill of the central banks.

You will encourage my timely update of this blog on the economy and financial markets by entering a subscription to The Peter Dag Portfolio.

Thank you for visiting this site.

George Dagnino, PhD

Editor, The Peter Dag Portfolio

Since 1977

Author, Profiting in Bull and Bear Markets

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

Subscribe now and learn "EASY WAYS TO BEAT THE MARKET WITH ETFs". Several portfolios back-tested from 2000 are shown in the subscribers' area on our website (www.peterdag.com) when you subscribe. Total returns, annualized returns, maximum losses during the period, and number of transactions are shown for each portfolio. The rules are easy to follow and you will find them in the appendix of each issue of The Peter Dag Portfolio. These portfolios are provided as a service to our subscribers.

This chart shows the inventory/sales ratio for business wholesalers (click on the chart to enlarge it).

Inventories keep rising much faster than sales, which is the reason the ratio is soaring. The worrisome element is the imbalance between inventories and sales has reached levels last seen in 2008-2009 when the economy and the financial markets were facing a dire outlook.

The only way to bring the growth of inventories in line with that of sales is to cut production. There is no other way. This is the reason industrial output has been weak since December 2014.

Excess inventories is causing production, all commodities, and yields to decline. As the economy weakens, profits suffer.

Yes, the business cycle is alive and well in spite of the mumbo jumbo and hot air exhaled by those in charge of our economic affairs.

You will encourage me to update this blog on the economy and financial markets by entering a subscription to The Peter Dag Portfolio.

Thank you for visiting this site.

George Dagnino, PhD

Editor, The Peter Dag Portfolio

Since 1977

Author, Profiting in Bull and Bear Markets

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

Subscribe now and learn "EASY WAYS TO BEAT THE MARKET WITH ETFs". Several portfolios back-tested from 2000 are shown in the subscribers' area on our website (www.peterdag.com) when you subscribe. Total returns, annualized returns, maximum losses during the period, and number of transactions are shown for each portfolio. The rules are easy to follow and you will find them in the appendix of each issue of The Peter Dag Portfolio. These portfolios are provided as a service to our subscribers.

The number of companies cutting dividends is soaring and has reached levels not seen since 2008 (see above chart).

This was the time when the economy was facing huge economic and financial problems - while the Fed's outlook was quite positive.

Companies are cutting dividends because profits are declining in Q1 and are also projected to decline in Q2.

These trends show an economy having serious problems. Which is the reason commodities (all of them, including oil and gold) are likely to go nowhere. Can equities go up in this environment?

You will encourage me to update this blog on the economy and financial markets by entering a subscription to The Peter Dag Portfolio.

Thank you for visiting this site.

George Dagnino, PhD

Editor, The Peter Dag Portfolio

Since 1977

Author, Profiting in Bull and Bear Markets

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

Subscribe now and learn "EASY WAYS TO BEAT THE MARKET WITH ETFs". Several portfolios back-tested from 2000 are shown in the subscribers' area on our website (www.peterdag.com) when you subscribe. Total returns, annualized returns, maximum losses during the period, and number of transactions are shown for each portfolio. The rules are easy to follow and you will find them in the appendix of each issue of The Peter Dag Portfolio. These portfolios are provided as a service to our subscribers.

Investors are afraid. They do not feel comfortable with the central banks nonsensical dialogue about NIRP, ZIRP, LTRO or QE. Trust is being eroded about the power of monetary policy or the capabilities of implementing wise growth oriented policies by our leaders - as demonstrated by the telling fight for the US presidency.

What do investors do when market conditions become uncertain? Buy gold, of course. Well, this is nonsense, as demonstrated by the above chart (click on the chart to enlarge it).

The chart shows the price of SPY (S&P 500), GLD, WTIC, and COPPER. They bottomed in mid January and rose (approximately) 10%, 14%, 34%, and 21% respectively.

My point is gold performs like any other commodity at important turning points of the commodity complex. There are always exceptions of course. But for the average investor is more prudent to think of gold as a commodity.

It is no coincidence gold peaked in 2011 like all other commodities and has declined since then - like most other commodities.

You will encourage me to update this blog on the economy and financial markets by entering a subscription to The Peter Dag Portfolio.

Thank you for visiting this site.

George Dagnino, PhD

Editor, The Peter Dag Portfolio

Since 1977

Author, Profiting in Bull and Bear Markets

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

Subscribe now and learn "EASY WAYS TO BEAT THE MARKET WITH ETFs". Several portfolios back-tested from 2000 are shown in the subscribers' area on our website (www.peterdag.com) when you subscribe. Total returns, annualized returns, maximum losses during the period, and number of transactions are shown for each portfolio. The rules are easy to follow and you will find them in the appendix of each issue of The Peter Dag Portfolio. These portfolios are provided as a service to our subscribers.

The survey of investment advisors of Investors Intelligence shows the percent of bulls and bears. The evidence shows the market tends to rally when the ratio of bulls/bears is at extremely low levels (as now). Stocks stop rising when the ratio of bulls/bears is at extremely high levels (as in 2011). (See above chart - click on the chart to enlarge it).

Although this is a great indicator, it does not work well all the times. Let me show you why.

In the bear market of 2008-2009, for instance, the bears/bulls ratio declined to bullish levels in 2008. The market, however, did not rally and kept declining. It eventually bottomed in 2009 with the bulls/bears indicator still at extreme low levels.

The point is extreme low levels of the bulls/bears indicator does not provide a useful timing signal if the market enters a protracted downturn.

The same pattern occurs in a protracted bull market as it happened during 2013-2015. The bulls/bears ratio reached extreme high levels, reflecting a large number of bulls. The market should have corrected, but it did not. Stocks kept rising strongly as advisers remained overwhelmingly bullish.

The point is financial advisers are momentum followers. When the momentum is strong, they follow the market up. When the market is weak they follow it on the downside.

What is this indicator saying now? The bulls/bears ratio is at extreme low levels. The advisers are worried and their concern is at levels that may reflect a change in trend as in 2008-2009. They may be right. On the other hand, they may signal a strong rally as they did in 2013.

I know, it is confusing, but this is exactly the limitation of this indicator.

The way I would use this gauge now is as follows. Yes, the market is oversold and it may bounce higher. However, the advisers may also be telling the market trend has changed and momentum may have shifted on the down side.

You will encourage me to update this blog on the economy and financial markets by entering a subscription to The Peter Dag Portfolio.

Thank you for visiting this site.

George Dagnino, PhD

Editor, The Peter Dag Portfolio

Since 1977

Author, Profiting in Bull and Bear Markets

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

Subscribe now and learn "EASY WAYS TO BEAT THE MARKET WITH ETFs". Several portfolios back-tested from 2000 are shown in the subscribers' area on our website (www.peterdag.com) when you subscribe. Total returns, annualized returns, maximum losses during the period, and number of transactions are shown for each portfolio. The rules are easy to follow and you will find them in the appendix of each issue of The Peter Dag Portfolio. These portfolios are provided as a service to our subscribers.

This graph shows why our economy is not growing. It shows business investment during the good old days when business could see opportunities as in the 1990s.

But since 2012 capital investments have not been growing. Business is confused. They do not understand the purpose of all these ZIRPs, NIRPs, and QEs. They do not understand them because they fueled a huge equity bull market with no improvement in profits.

Business recognizes that the price mechanism has been severely distorted and the markets are not giving the right feedback because pricing channels have been neutered by the central banks. Why then should they invest in the future? The correct strategy is to wait and see for the fog to clear.

You will encourage me to update this blog on the economy and financial markets by entering a subscription to The Peter Dag Portfolio.

Thank you for visiting this site.

George Dagnino, PhD

Editor, The Peter Dag Portfolio

Since 1977

Author, Profiting in Bull and Bear Markets

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

Subscribe now and learn "EASY WAYS TO BEAT THE MARKET WITH ETFs". Several portfolios back-tested from 2000 are shown in the subscribers' area on our website (www.peterdag.com) when you subscribe. Total returns, annualized returns, maximum losses during the period, and number of transactions are shown for each portfolio. The rules are easy to follow and you will find them in the appendix of each issue of The Peter Dag Portfolio. These portfolios are provided as a service to our subscribers.

...... if firms do have funds to invest, they are too uncertain about future economic conditions and so whether the possible return on investment will justify its cost. ......... this second explanation would imply that easy conditions are not the key determinant of investment. This section discusses these two hypotheses in turn.

This statement was taken from the quarterly report of the Bank of International Settlements (BIS, the bankers' bank).

What is amazing to me is the even THEY know full well that NIRP, ZIRP and QEs do nothing to improve the world economies. In fact one can make the conclusion that these monetary policies punished the global economies rather than help them.

Economies cannot grow without investments to improve productivity. This is not happening because the markets are not providing the right signals. The outcome is that business people are confused.

The pricing mechanism has been distorted with equity markets soaring because of increasing stimulus and not because or rising profits.

You will encourage me to update this blog on the economy and financial markets by entering a subscription to The Peter Dag Portfolio.

Thank you for visiting this site.

George Dagnino, PhD

Editor, The Peter Dag Portfolio

Since 1977

Author, Profiting in Bull and Bear Markets

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

Subscribe now and learn "EASY WAYS TO BEAT THE MARKET WITH ETFs". Several portfolios back-tested from 2000 are shown in the subscribers' area on our website (www.peterdag.com) when you subscribe. Total returns, annualized returns, maximum losses during the period, and number of transactions are shown for each portfolio. The rules are easy to follow and you will find them in the appendix of each issue of The Peter Dag Portfolio. These portfolios are provided as a service to our subscribers.